Welcome to DBNC’s free Income Tax services

What does our Tax team do?

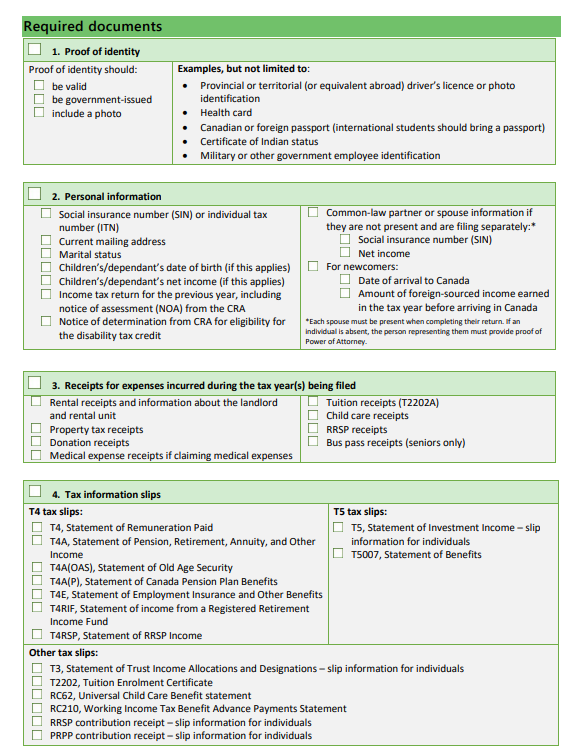

Through the Community Volunteer Income Tax Program (CVITP), DBNC hosts a free tax clinic where trained dedicated volunteers file taxes for people with a modest income and a simple tax situation who are eligible as per DBNC’s guidelines.

We also offer short consultation appointments for any tax-related questions you may have.

Our all-year tax clinic is open from May to January, where volunteers file taxes for 2016-2024 and offer consultation appointments.

Please read through our Frequently Asked Questions (FAQ) below before booking an appointment.

Frequently Asked Questions (FAQs)

Please read through the FAQ’s before booking a Consultation or a Tax Filing Appointment:

How to get your taxes filed?

STEP 1: Confirm Eligibility

Find out if you are ELIGIBLE and register!

Confirm your eligibility and complete the registration form

STEP 2: Book an Appointment

Once you have completed the registration form in Step 1, if you are eligible, the booking link will be automatically shared with you on the final confirmation page of the registration form and via email.

PLEASE NOTE: We do not accept walk-ins. You must first register and then book an appointment with DBNC’s Tax Clinic to ensure we can file your taxes or answer your questions during a consultation appointment.

Contact Us

Still unsure what to do? Please contact us

Email: [email protected]

Phone: +1 (905) 629-1873 Ext.298